Why do the Franciscans eventually involve themselves in finances?

Since the beginning of time, clergy have often been the most educated people in any given society: they advised, advocated, explored, healed, taught, and …created culture. Therefore, they were the natural and trusted intermediaries.

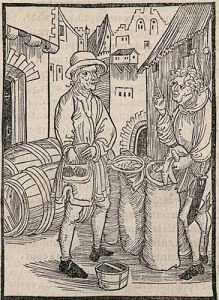

Because they desired to alleviate poverty and combat injustice, the friars wished to assist merchants (the rising middle class) because they were now the major employers of the jobless. They also donated to charity, sponsored the arts, and worked for laws that maintained the peace.

Usury is an exorbitant charge of interest when lending money (50-100%). Though interest was not prohibited in Greek law, Plato and Aristotle condemned it as an obnoxious kind of money-making. It imperiled the welfare of the state by setting one class against another, and by seeking gain from barren metal. In the Old Testament there is no absolute prohibition of interest, but many passages condemn the gaining of wealth by oppressing the poor with usury. The New Testament contains no explicit statement on the ethics of interest but does see it as a violation of charity and mercy. Most people condemned moneylending as a profession because of its typical practice of charging exorbitant interest and taking advantage of borrowers in distress.

Here’s a timeline of the early influence of Franciscans on the world of finance –

- 1209: The friars are poor mendicants.

- 1462: The friars become the founders of the modern banking system when the Bishop of Perugia charters the first

- Bernardine of Feltre’s insistence on charging a low interest to protect the institution’s permanency raised a controversy among theologians who thought it promoted the continuance of usury. The Dominicans were especially opposed to the Monte, claiming it was against the friars’ ideal of living poverty by becoming financiers.

- 1494: The friars become the founders of the modern accounting system with the invention of the double-entry system.

- 1515: Pope Leo X declared the institution of the Monte di Pietà to be meritorious and threatened with excommunication anyone who spoke against the friars and their new low-interest lending system. With his bull, Inter multiplicis, Pope Leo condemned usury but promoted the Monte allowing a small interest to be charged for employee compensation, management, and administration expenses.

- Mission of the Monte: “To honor God and to alleviate the personal poverty of those in need.” Some preachers referred to coins (their rounded shapes) as a metaphor for the sacred host – that which enables a decent life.

- Even today, some banks in Italy founded as a Monte, at the end of the fiscal year, still donate to charity and the arts, and sponsor all sorts of cultural projects.

This series is from a presentation by Friar Joseph Wood, Assistant General for the CFF.

In part three – The Monte di Pietà or deposit of charity –

Pingback: More About Monte di Pietà – Franciscan Voice